At South Salt Lake Valley Mosquito Abatement District we believe in and support the transparent Utah initiative. This website is used to provide the public with information about the use of property tax dollars by public entities. Below you will find links and instruction on how to access some of our most commonly requested information.

See our Board Meeting Schedule, Trustee Info, Board Meeting Agendas, Minutes, and other required notices

Financial information is uploaded quarterly, compensation information annually. We are on a calendar fiscal year.

See our compliance with audit reports, financial statements, budgets, fraud risk, etc.

If there are public records you would like, please complete a formal GRAMA request through the Online Records Portal managed by the State Archives.

The District creates an official report annually of its operations. Click the title for the latest report available in pdf format.

Property Tax Information

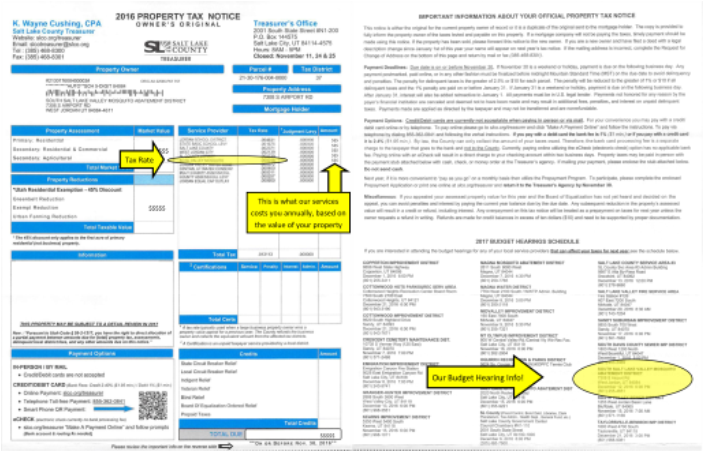

All of our operating funds come directly from property taxes paid by home and business owners within our District. Each year we are required to set our property tax rate through the Salt Lake County Treasurers Office no later than June 22. Property tax estimates are typically mailed by the county to all homeowners in the summer with a final tax statement and bill sent in November for collection. You can determine individual entity tax rates and contributions by looking at your annual property tax notice, click to enlarge the highlighted examples below. We are typically the smallest amount on your statement, besides the county assement and collection fee, averaging about $2.75 on a $250,000 home.

Tax Rate History/Facts:

The last time our District raised taxes was 2010, when we doubled our tax rate (to 0.000050) in order to build our new facility in West Jordan.

However, only two years later in 2012, we cut our rate by more than half, LOWERING our rate below what it was prior (to 0.000021) and have kept it there since. Essentially, our current certified tax rate has remained the same (except for the aforementioned short-term tax increase) since our last tax rate increase in 2003.

We are significantly under the 0.0004 maximum rate allowed by state law